Schedule of Tariff Commitments

Explanatory Notes

1. The tariff lines subject to tariff reduction and/or elimination under this Annex are categorised as follows:

(a) Normal Track

(i) Applied MFN tariff rates for tariff lines placed in the Normal Track will be reduced and subsequently eliminated in accordance withthe following tariff reduction and elimination schedule:

• Normal Track 1:

1 January 2010 to 31 December 2013 for Brunei Darussalam, Indonesia, Malaysia,Singapore and Thailand, and India

1 January 2010 to 31 December 2018 for the Philippines and India

1 January 2010 to 31 December 2013 for India and 1 January 2010 to 31 December 2018 for Cambodia, Lao PDR, Myanmar and Viet Nam

• Normal Track 2:

1 January 2010 to 31 December 2016 for Brunei Darussalam, Indonesia, Malaysia,Singapore and Thailand, and India

1 January 2010 to 31 December 2019 for the Philippines and India

1 January 2010 to 31 December 2016 for India and 1 January 2010 to 31 December 2021 for Cambodia, Lao PDR, Myanmar and Viet Nam

(ii) Where the applied MFN tariff rates are at 0 per cent, they shall remain at 0 per cent. Where they have been reduced to 0 per cent, they shall remain at 0 per cent. No Party shall be permitted to increase the tariff rates for any tariff line, except as otherwise provided in this Agreement.

(b) Sensitive Track

(i) Applied MFN tariff rates above five (5) per cent for tariff lines in the Sensitive Track will be reduced to five (5) per cent in accordance with the followingtariff reduction schedules:

1 January 2010 to 31 December 2016 for Brunei Darussalam, Indonesia, Malaysia, Singapore and Thailand, and India

1 January 2010 to 31 December 2019 for the Philippines and India

1 January 2010 to 31 December 2016 for India and 1 January 2010 to 31 December 2021 for Cambodia, Lao PDR, Myanmar and Viet Nam

(ii) Applied MFN tariff rates of five (5) per cent can be maintained for up to 50 tariff lines.

For the remaining tariff lines, applied MFN tariff rates are reduced to 4.5 per cent upon entry into force of the Agreement for ASEAN 62 and five (5) years from entry into force of the Agreement for Cambodia, Lao PDR, Myanmar and Viet Nam. The AIFTA preferential tariff rate for these tariff lines are further reduced to four (4) per cent in accordance withthe end-date set in subparagraph (i).

(iii) Applied MFN tariff rates on four (4) per cent of the tariff lines placed in the Sensitive Track, as will be identified by each Party on its own accord and exchanged with other Parties, will be eliminated by:

31 December 2019 for Brunei Darussalam, Indonesia, Malaysia, Singapore3 and Thailand, and India

31 December 2022 for the Philippines and India

31 December 2024 for Cambodia, Lao PDR, Myanmar and Viet Nam

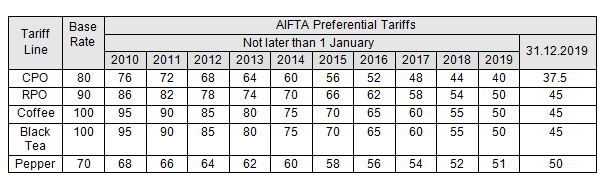

(c) Special Products

(i) Special Products refer to India’s crude and refinedpalmoil (CPO and RPO, respectively), coffee, black tea and pepper.

(ii) Applied MFN tariff rates for the Special Products will be reduced in accordance with the following tariff reduction schedules:

(iii) Any better offers made by India to other competingoils/fats shall also be duly offered to palm products.

(iv) If the applied MFN tariff rate for CPO and RPO is lower than the preferential tariff under the AIFTA, the lower applied rate shall prevail.

(d) Highly Sensitive Lists4

Tariff lines placed by the Parties in the Highly SensitiveListare classified into three (3) categories, i.e.:

(i) Category 1: reduction of applied MFN tariff rates to 50 per cent;

(ii) Category 2: reduction of applied MFN tariff rates by 50 per cent; and

(iii) Category 3: reduction of applied MFN tariff rates by 25 per cent,

and such tariff reduction shall be achieved by 31 December 2019 for Indonesia, Malaysia and Thailand, 31 December 2022 for the Philippines, and 31 December 2024 for Cambodia and Viet Nam.

(e) Exclusion List

Exclusion Lists shall be subject to an annual tariff review with a view to improving market access.

2. No applied tariff among the Parties shall exceed the rates scheduled in this Agreement. However, if the applied MFN tariff rate is lower than the scheduled rate, it shall be applied to all Parties.

3. For tariff lines subject to specific tariff rates, tariff reduction and/or elimination are in accordance with the modality and timeframes of the category within which such tariff lines are placed. The proportion of tariff reduction for these tariff lines is equal to the average margin of tariff reduction of the tariff lines with ad-valorem tariff rates that are subject to tariff reduction in the same year.

4. Notwithstanding the Schedules in this Annex, nothing in this Agreement shall prevent any Party from unilaterally accelerating the tariff reduction or unilaterally transferring any of the products or tariff lines in the Highly Sensitive or Special Product Lists to the Sensitive Track or Normal Track, or tariff lines in the Sensitive Track to the Normal Track.

5. Parties shall enjoy the tariff concessions made by the other Parties for tariff lines as specified in and applied pursuant to the relevant tariff reduction/elimination schedule in this Annex together with the undertakings and conditions set out therein as long as that Party adheres to its own commitments for tariff reduction/elimination for that tariff line.

6. The tariff rates specified in the Schedules in this Annex set out only the level of the applicable AIFTA preferential tariff rates to be applied by each Party for the tariff lines concerned in the specified year of implementation and do not prevent any Party from unilaterally accelerating its tariff reduction or elimination at any time.

7. For a Party for which this Agreement enters into force at a date later than 1 January 2010, the initial reduction or elimination of customs duties shall be implemented at the level specified in that Party’s schedule of tariff commitment for the year in which the Agreement enters into force for that Party.

___________

2 Special arrangements for Thailand apply

3 Modality for Sensitive Track does not apply to Singapore

4 Modality for Highly Sensitive List does not apply for Brunei Darussalam, Lao PDR, Myanmar and Singapore