The Department of Trade and Industry-Export Marketing Bureau (DTI-EMB) is pushing for the passage of House Bill No. 6815 or the Accelerated Recovery and Investments Stimulus for the Economy of the Philippines (ARISE Philippines) to help exporters get back on their feet. The bill was approved by the House of Representatives in its third and final reading on 4 June 2020.

Formerly called the Philippine Economic Stimulus Act (PESA), HB6815 seeks to offer various forms of assistance to micro, small, and medium enterprises (MSMEs) and other key sectors, including exports, affected by the COVID-19 crisis, while at the same time rebuilding consumer confidence.

“As the primary government agency for export promotions, our priority is to help exporters affected by the pandemic. While we continue our services, we are also advocating for the immediate implementation of ARISE Philippines to provide financial assistance to businesses and employees,” said DTI-EMB Director Senen M. Perlada.

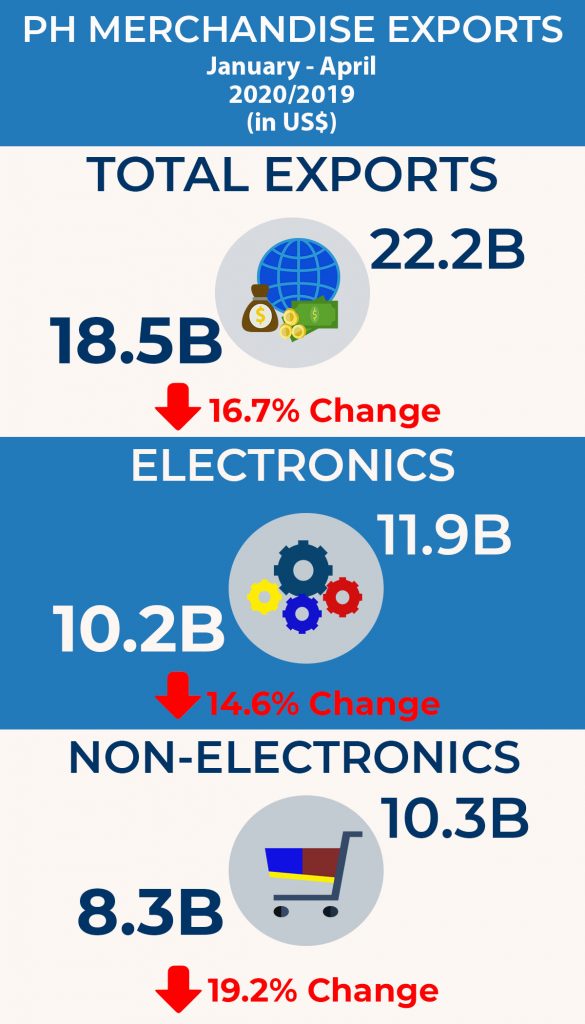

Reeling from the severe effects of the Covid-19 pandemic, Philippine (PH) goods exports in April 2020 was less than half that of the same month last year, plummeting by 50.8% to USD2.8B from USD5.7B in April 2019, according to the latest preliminary data from the Philippine Statistics Authority (PSA). This resulted in a steep 16.7% decline in exports year-to-date (YTD) to USD18.5B from USD22.2B in the same period last year.

“There is weak demand abroad due to fear factor. The lockdowns and quarantine measures also decreased the consumption of discretionary goods and services and caused brick and mortar stores and restaurants to close down,” he continued.

Meanwhile, DTI Undersecretary for Trade Promotions Group (TPG) and Special Concerns Abdulgani M. Macatoman said that based on the recent exporters’ survey, many exporters were not able to operate due to disruption in supply chain, especially availability of raw materials and packaging.

Biggest contributors to the huge drop of export sales in April 2020 were seven of the top 10 major export commodities for the month, led by other manufactured goods (-64.0%); machinery and transport equipment (-63.6%); and coconut oil (-55.5%).

Electronics made up more than half of the country’s merchandise exports (55.5%) in the review period, while the remaining 45% was comprised of non- electronics. Electronics exports plunged by 14.6% in the first four months of the year to USD10.2B from USD11.9B posted in the same period in 2019. Meanwhile, non-electronics declined by 19.2% to USD8.3B YTD from USD10.3B in the same period last year.

The top 5 electronics exports in terms of value contributed 96.5% share in the total YTD industry value and 53.1% in the total value of goods exports.

Semiconductors maintained its position as the top merchandise export of PH, comprising 76.6% of Electronics exports and 42.2% of total PH merchandise exports. However, semiconductor exports went down by 10.6% to USD7.8B in the first four months of 2020 from USD8.6B posted in the same period in 2019.

Mirroring the YOY declines in total exports, PH shipments to its top 10 export market destinations in April 2020 posted negative YOY growth rates. Massive declines were posted in major markets such as the US (65.8%), Germany (62.0%), and Korea (56.0%). The three biggest YOY market decliners were also the biggest YTD losers led by the US (23.7%), followed by Korea (20.7%) and then by Germany (19.6%).

In terms of markets, almost 60% of the total exports in the top 10 PH export markets went to only three economies: China and Hong Kong (26.8%), Japan (16.2%), and US (14.8%). Overall, total exports to the top 10 PH markets declined by 15.3% to USD16.0B YTD from USD18.9B posted in the same period a year ago. “Now that we are in the New Normal, DTI is exploring digital marketing, like online business-matching, to help exporters find new markets or expand to other destinations. Even after the pandemic, the shift to online trade may remain and we must be prepared for that,” said Macatoman. ♦

Date of Release: 11 June 2020