Philippines-European Free Trade Association (EFTA) Free Trade Agreement (FTA)

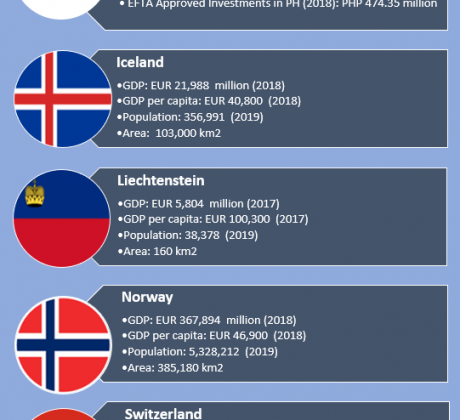

EFTA (composed of Iceland, Liechtenstein, Norway and Switzerland) first conveyed its interest to have a Free Trade Agreement (FTA) with the Philippines in February 2009. Following a series of high-level contacts, two expert group meetings were convened in June 2013 and November 2013 to discuss ways forward. At the Philippines-EFTA Ministerial Meeting in November 2013, both sides agreed to work towards signing a Joint Declaration as an initial step to FTA negotiations. The Joint Declaration on Cooperation between the Philippines and the EFTA States was signed on 23 June 2014 in Iceland. FTA scoping discussions were held subsequently and concluded during a high-level scoping meeting in November 2014 in Switzerland.

FTA negotiations were launched in Manila in March 2015 and in February 2016, FTA negotiations were concluded after five rounds. Ministers and Representatives of the Philippines and the EFTA Member States signed the Agreement on 28 April 2016 in Bern, Switzerland. The Agreement entered into force on 1 June 2018 for the Philippines, Norway, Liechtenstein and Switzerland and on 1 January 2020 for Iceland.

Upon entry into force of the Agreement, exporters to the EFTA markets are no longer required to secure a Certificate of Origin from the Bureau of Customs (BOC) under the FTA’s self-certification/self-declaration system. All exporters are encouraged to register with the Bureau of Customs as an approved exporter under the FTA. Detailed guidelines on this can be found in Customs Memorandum Order No. 14-2018.

Coverage

The PH-EFTA FTA covers Trade in Goods (TIG), Trade in Services (TIS), Investments, Intellectual Property (IP), Government Procurement (GP), Competition, and Trade and Sustainable Development.

Rationale for Engaging EFTA

The PH-EFTA FTA is part of the country’s strategy to gain stronger foothold in the European market. The Philippines’ Europe Strategy is to: (1) maximize preferences under the European Union (EU) Generalized Scheme of Preferences (GSP+) that provides for duty-free market access to 6,274 EU tariff lines; (2) negotiate Philippines-EU FTA, building on the gains under GSP+ to provide for a framework to increase services trade and investments; and (3) pursue Philippines-EFTA FTA to expand market to non-EU member states. While PH-EFTA economic relations is relatively small, there is large potential to expand trade and investment relations with EFTA.

Key Outcomes/Benefits for the Philippines

The FTA provides the Philippines duty-free market access for ALL industrial and fisheries tariff lines upon entry into force of the FTA. PH also secured tariff concessions on substantially all PH agriculture exports to EFTA (e.g., frozen tuna/mackerel, canned pineapple, crude coconut oil, fresh/dried bananas). In addition, the PH also gained significant concessions on our agricultural exports, particularly those that are currently being exported to the EFTA Members States, or those with high potential export interest, including those that are being sold to its neighboring European countries, which can alternately be exported to the EFTA countries.

The FTA also features liberal rules of origin. For instance, the PH may qualify for zero tariffs for preparations of meat/fish, even if the meat or fish is imported. PH garment exports may also claim preferential tariffs even if textiles used are imported and only cut and sew processing is done in the country.

Philippine service suppliers who want to enter the EFTA market can benefit from the commitments made by EFTA in all modes of supply. Commitments in cross border supply and movement of natural persons present opportunities for both skilled workers and professionals, particularly architects and engineers. For movement of natural persons, the entry and temporary presence of intra-corporate transferees (covering executives/managers and specialists) and business visitors will be allowed, and in some cases, the application of the economic needs tests will be waived. Switzerland in particular added an additional category of personnel in the form of installers and maintainers and includes the contractual requirement to develop local skills through training in the Philippines. qwer

Important Documents/Links

- Philippines-European Free Trade Association Free Trade Agreement (PH-EFTA FTA)

- Annexes

- Trade in Goods

- Annex I – Rules of Origin

- Annex II – Product Coverage of Non-Agricultural Products

- Annex III – Philippines Schedule of Tariff Commitments on non-agricultural products from EFTA

- Annex IV – Export Duties

- Annex V – Trade in Fish and Other Marine Products

- Annex VI – Trade Facilitation

- Annex VII – Mandate Sub-Committee

- Annex VIII – Schedule of Tariff Commitments on Agricultural Products, Philippines-Iceland

- Annex IX – Schedule of Tariff Commitments on Agricultural Products, Philippines-Norway

- Annex X – Schedule of Tariff Commitments on Agricultural Products, Philippines-Switzerland

- Trade in Services

- Annex XI – Schedules of Specific Commitments

- Annex XII – List of MFN Exemptions

- Annex XIII – Financial Services

- Annex XIV – Telecommunications Services

- Annex XV – Movement of Natural Persons Supplying Services

- Annex XVI – Maritime Transport and Related Services

- Annex XVII – Energy Related Services

- Intellectual Property

- Trade in Goods

- Executive Order No. 61 series of 2018 – Modifying the Rates of Import Duty on Certain Imported Articles in Order to Implement the Philippine Tariff Commitments Pursuant to the Free Trade Agreement Between the European Free Trade Association States and the Philippines

- Customs Memorandum Order No. 14-2018 – Guidelines on the Implementation of the Free Trade Agreement Between the European Free Trade Association and the Philippines

- Tariff Commission’s Tariff Finder

- EFTA Website

- EFTA member states’ WTO member trade profile

- Further information on the EFTA member states’ trade policies

Related Data/Statistics

Sources: EFTA TIRs, EFTA 2019 Annual Report

For more details, contact the Bureau of International Trade Relations-Bilateral Relations Division (BITR-BRD) at brd_efta@dti.gov.ph.